Taking Note: COVID-19 Arts Watch—Federal Data Update

Since our last installment on this blog in early May, federal data have begun to chart the disproportionate toll of COVID-19 on the arts sector, compared with many other segments of the U.S. economy. A prime exhibit is the “Business Pulse” survey, a weekly questionnaire sent to 100,000 random small businesses (those with fewer than 500 employees).

An experimental tool of the U.S. Census Bureau, the survey began April 26 and will run through June 27. Early findings show that arts-related small businesses are among the most likely to report declining revenue and a negative impact on their businesses in general. They also are more likely than other small businesses to report lasting effects from COVID-19 on their operations.

According to the most recent period of data collection (May 24-30, 2020), 71 percent of small businesses in the “Arts, Entertainment, and Recreation” sector reported a “large negative effect” from the pandemic, compared with 43 percent of all small businesses. That level is exceeded only by the “Accommodation and Food Service” sector (with 77 percent in the sector reporting a large negative effect to their businesses).

Fifty-seven percent of small businesses in Arts, Entertainment, and Recreation said their revenues had declined over the past week. Although that figure is comparable to the 54 percent of all small businesses now reporting revenue shortfalls, far greater percentages of small businesses in the Arts sector had reported such losses in previous weeks of the survey. In the first week of the survey (covering April 26 to May 2), for example, 80 percent of all Arts small businesses reported declining revenue, compared with 74 percent of all small businesses.

Regarding long-term prospects for recovery, 57 percent of small businesses in the Arts sector—and 41 percent of all small businesses—expect more than six months to elapse before they will resume their “normal level of operations.” Twelve percent of Arts small businesses do not expect the sector ever to recover to normal levels.

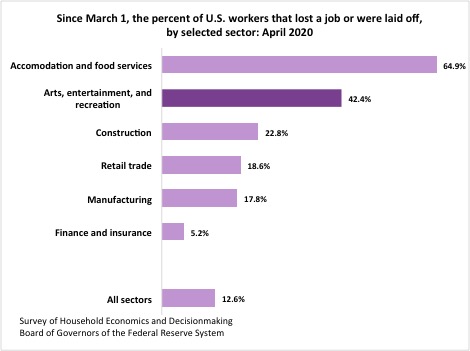

What about employment patterns in the arts? The Federal Reserve Board maintains a dataset called the Survey of Household Economics and Decisionmaking. In April 2020, a special module of the survey attempted to understand labor market effects and households’ financial circumstances during the COVID-19 stay-at-home orders. According to the household survey data, 42 percent of workers in Arts, Entertainment, and Recreation lost a job, or were laid off or told not to work any hours.

That share was lower than for Accommodation and Food Service workers, but higher than for workers in all sectors, or in sectors such as construction or finance/insurance (see chart below).

Using data from another federal source—the U.S Bureau of Labor Statistics’ (BLS) Current Employment Statistics (CES)—we can estimate cuts in employment based on seasonally adjusted payroll statistics from a variety of industries. Between March and April 2020, employment in the Arts, Entertainment, and Recreation sector fell from roughly 2.4 million to 1.1 million, a drop of 54.1 percent.

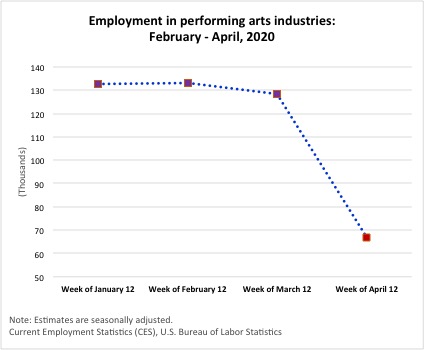

Admittedly, the “Arts, Entertainment, and Recreation” is a broad sector, covering not only for-profit and nonprofit arts establishments but also sports venues, amusement parks, golf courses, and marinas. However, new CES data (released on June 5) permit us to parse employment trends for some specific arts/cultural industries. According to the CES, employment in the performing arts fell by 48 percent—nearly 62,000 workers—between mid-March and mid-April 2020. (See below for a graph of CES trends starting in mid-January 2020.)

Those are drops in the number of payroll workers. A more common metric is the unemployment rate, as reported by BLS from the U.S. Census Bureau’s Current Population Survey (CPS). The CPS is a household survey. Significantly, the numbers include self-employed workers. Based on May 2020 data from the CPS, the unemployment rate for workers in arts, entertainment, sports, and media occupations is 17.9 percent—4.5 times greater than the May 2019 rate of 4 percent. This figure is far above that for all other “professional” workers (7.7 percent) and workers in all occupations as a whole (12.7 percent).

These statistics are not for the faint of heart. Still, it is important to know where the most current data sources may be found for the purpose of informing national and regional policymakers about the arts’ share of the U.S. economic burden. We hope in the next installment to highlight some reports and best practices that use research to drive cross-sector conversations about COVID-related recovery.